2026 Mini Split Tax Credits & Rebates: How to Claim Your $2,000 (Inflation Reduction Act)

Installing a mini split is a smart investment, but the upfront cost can be painful. What if I told you the IRS wants to pay for 30% of your new AC?

Thanks to the Inflation Reduction Act (IRA) and the Energy Efficient Home Improvement Credit (25C), homeowners can get massive tax breaks for installing heat pumps in 2026.

This is not a scam. It is federal law. But the rules are confusing. What SEER rating do you need? Which form do you file? In this guide, I will simplify the tax code so you can get your money back.

The “25C” Federal Tax Credit: The Big One 🇺🇸

Starting in 2023 and running through 2032, the federal government offers a tax credit of 30% of the project cost, capped at $2,000 per year.

How It Works:

- Project Cost: Includes the unit AND installation labor.

- The Math: If you spend $5,000 on a new MrCool setup, you get $1,500 deducted directly from your taxes.

- The Limit: The maximum you can claim is $2,000. So if you spend $10,000, you get $2,000 back.

⚠️ Important: This is a “Tax Credit,” not a deduction. A credit reduces your tax bill dollar-for-dollar. It is better than a deduction!

Eligibility: Which Units Qualify? ✅

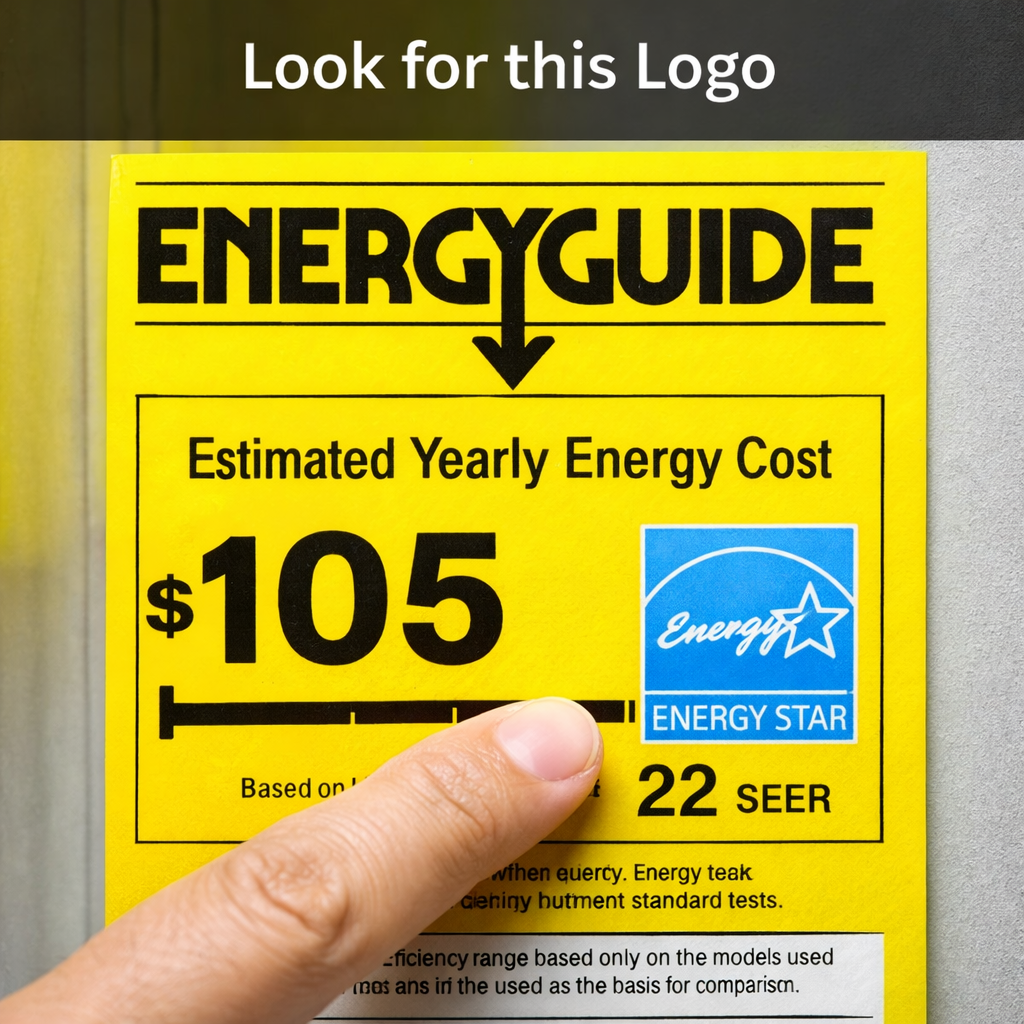

Not every cheap mini split on Amazon qualifies. To get the free money, the unit must meet specific efficiency standards (Consortium for Energy Efficiency – CEE Tiers).

General Requirements (2026):

- SEER2 Rating: Must be usually 16 SEER2 or higher (varies by North/South region).

- HSPF2 Rating: Must be high efficiency for heating.

- Energy Star: Look for the “Energy Star Cold Climate” badge.

- Does MrCool DIY Qualify? Yes! Most of the MrCool DIY Gen 4 series and Olympus series meet these requirements.

- Does Senville Qualify? Yes, the Senville Aura (Leto) series generally qualifies.

State Rebates: The “Cherry on Top” 🍒

In addition to the federal $2,000, your individual state might have the “HEEHRA” Rebate Program.

- For Low-Income Households: You could get up to $8,000 off instantly at the point of sale.

- How to check: Go to the DSIRE USA website and type in your zip code.

👉 Mini split decisions can get expensive fast. 👉 Avoid mistakes with this full guide.

How to Claim It (The Paperwork) 📝

Don’t worry, it’s easy. You don’t need a lawyer.

- Keep your Receipt: Save the invoice showing the cost of the unit and labor.

- Keep the AHRI Certificate: This is a paper that proves the unit’s efficiency (you can download it from the manufacturer’s site).

- File Form 5695: When you do your taxes (April 15th), add IRS Form 5695. Enter the amount on the line for “Qualified Energy Property.”

Conclusion: Don’t Leave Money on the Table

If you are on the fence about buying a high-efficiency unit (like MrCool or Pioneer), remember the tax credit effectively discounts the price by 30%. That makes a high-end unit cheaper than a low-end one!

Ready to shop for qualifying units? Check out our comparison of the top brands: 👉 MrCool vs. Senville: Which is Better Value?